China's OLED materials companies to grow total sales by 58% by 2024

According to the statistics of DSCC, the total sales of Chinese OLED material enterprises reached US$252 million in 2024, which realized a strong growth of 58% compared with the previous year, and the growth rate is much faster than the 22% growth rate of global OLED material sales last year.

Although DSCC has not yet announced the total size of the entire market, but according to industry sources estimate that China's OLED materials companies accounted for about 11% - 12% of the total sales in the global market. On the contrary, South Korea's major OLED material companies include LG Chem, Samsung SDI, Tokuyama Group's Neolux, Solus Advanced Materials, and SFC (a joint venture between Samsung Display and Japan's Horita Manufacturing). According to some sources, the total sales of Korean OLED material companies account for nearly 40% of the world.

In China, OLED, Lite Optoelectronics, Xiahe are among the major OLED materials companies. DSCC revealed that BOE has already begun to purchase some key materials from Xiahe, which were previously supplied exclusively by the U.S.-based UDC and Novaled (Samsung's subsidiary), including green dopant (UDC) and p-type dopant (Novaled).

China's OLED materials enterprises supply to local panel companies has been a significant change in the structure of the product, from the past relatively single general-purpose layer gradually expanded to red (R), green (G), blue (B) light-emitting layer and p-type dopant and other diversified areas. Take Olaid as an example, its fist product focuses on the electron injection layer (EIL) and red, green and blue light-emitting materials, etc.; Lite-On Optoelectronics has established a firm foothold in the market by virtue of its green body materials.

DSCC in-depth analysis pointed out that China's OLED material enterprises sales rise is mainly attributable to two aspects: First, China's panel enterprises OLED production line start rate is steadily climbing; Second, the area put into production continues to increase.

It is worth mentioning that, although this information is not specifically mentioned, it is understood that China's small and medium-sized OLED production line start-up rate is still maintained at a high level of about 90%. Back to 2023, Tianma and other companies took the lead in launching the OLED cost-effective strategy, which significantly increased the penetration rate of OLED in the Chinese smartphone market. As a result, Chinese smartphone vendors have opted for affordable OLED screens on lower-priced models, and it has been difficult for liquid crystal display devices (LCDs) to regain share in this market as consumers “find it hard to go back” after the experience.

In the Chinese market, the lowest price of 6-inch smartphone OLED screen had dipped to the beginning of $10 in the first half of 2023, however, by last year, the price has gradually recovered to around $20, and is still basically stable in this price range.

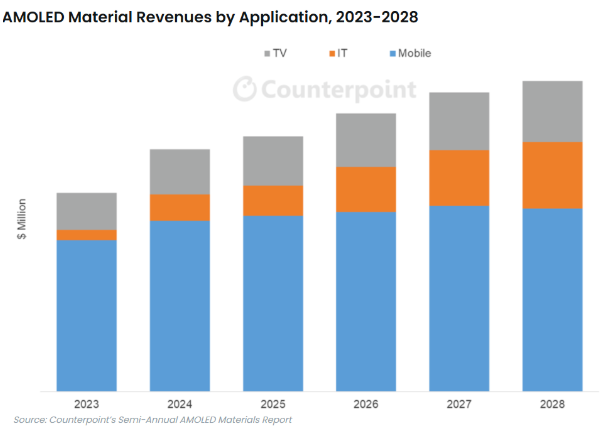

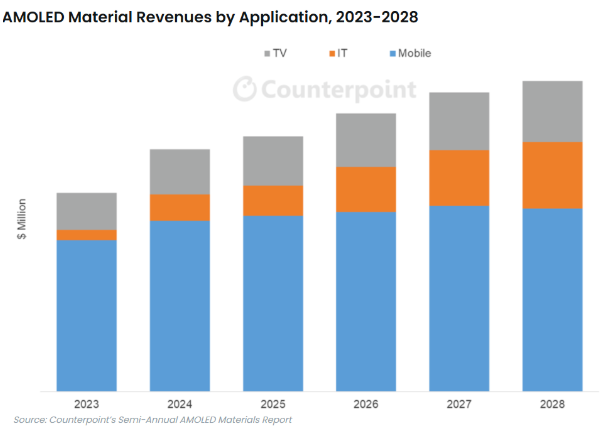

In terms of the composition of the overall OLED material sales, broken down by application areas, mobile products (smartphones, watches, etc.) accounted for the largest share, followed by TVs, and IT products. DSCC predicts that OLED material sales for IT products experienced significant growth last year, and it is expected that they will successfully overtake the sales of TVs by 2028. In fact, just last year, Apple officially launched the first OLED version of the iPad Pro, adding to this trend.

DSCC's comprehensive assessment shows that although most of the products produced by Chinese OLED material companies are sold in the local market at this stage, the performance gap between their products and those of the world's top companies is gradually narrowing. Especially in the track of supplying to Chinese panel companies, the competition between global OLED material companies and local Chinese companies is getting hotter and hotter.

Looking forward, the global OLED materials market is expected to grow at a solid compound annual growth rate (CAGR) of 6.4% from 2024 to 2028. DSCC further explained that although the recovery of LG Display's large-scale white (W)-OLED production line start-up is lagging behind expectations, expanding demand from Chinese manufacturers for mobile and IT products will be the driving force behind the OLED materials market. The DSCC will continue to be a key driver of growth in the OLED materials market.

Recalling last July, DSCC boldly predicted that LG Chem was expected to overtake DuPont to take the second place in the global OLED material sales ranking in that year. At that time, the estimated rankings were: top UDC, second LG Chem, third DuPont, fourth Samsung SDI, fifth Idemitsu Kogyo, etc. DSCC also predicted that LG Chem would overtake DuPont in the global OLED materials sales rankings. In addition, DSCC expects the gap between LG Chem and DuPont to widen further by 2025.

In the wave of competition in the market, LG Chem's performance is quite remarkable. First, it successfully snatched the hole blocking layer market for small OLED material kits of Samsung Display from Solus Advanced Materials, and then it has been steadily supplying p-type dopant to LG Display since the end of 2023. Back in October 2023, LG Display announced in a high profile that it had finally developed p-type dopant independently after more than 10 years of joint research with LG Chem, breaking Novard's exclusive monopoly in the field.