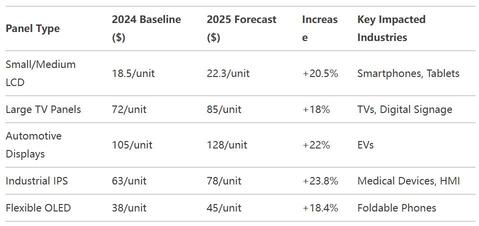

Amid ongoing turbulence in global supply chains, display panels—as core components of electronics manufacturing—are experiencing price fluctuations that directly impact profit margins across industries including consumer electronics, automotive displays, and industrial equipment. According to the latest forecasts from Display Supply Chain Consultants (DSCC), structural cost increases for imported panels in 2025 could exceed 30% for certain categories. This report delves into the five key drivers behind these price hikes, provides detailed projections by panel type, and outlines actionable strategies for businesses of all sizes.

1.1 Soaring Raw Material Costs: Supply-Demand Imbalance

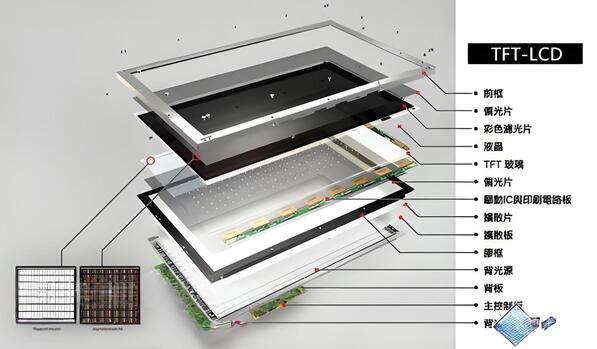

Glass Substrates: Major suppliers like Corning announced an 8-12% price increase for Q1 2025 due to shortages of high-purity quartz sand.

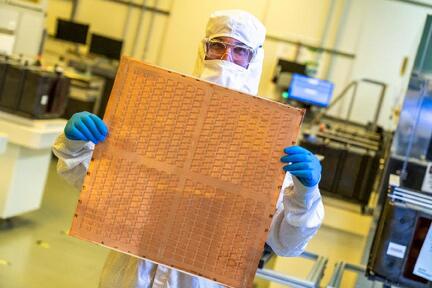

Driver ICs: A 15% rise in 28nm wafer fabrication costs will add 5-7% to panel BOM costs.

Polarizers: Japan’s Nitto Denko-dominated COP film prices surged 23% YoY (Source: TrendForce).

U.S. China Tariffs: Duties on select display panels may increase from 7.5% to 15%.

Red Sea Crisis Aftermath: Asia-Europe shipping costs remain 180% above 2023 peaks.

Regional Production Shift: Mexico/Vietnam assembly costs are 18-25% higher than China’s.

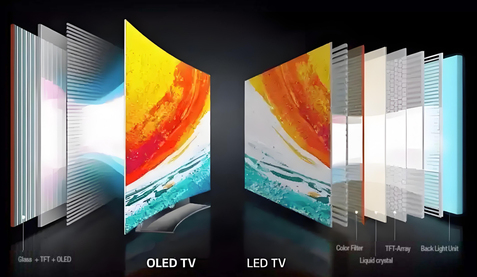

Samsung Display’s L8 LCD-to-QD-OLED conversion creates short-term capacity gaps.

BOE’s Chongqing B16 plant upgrades reduce LTPS panel output by 40K units/month.

Special Alerts:

Lead times for industrial panels >10.1" may extend by 6-8 weeks.

Samsung VA panels to adopt "floating pricing" with quarterly ±5% adjustments.

Price Lock Agreements: Secure 6-12-month fixed rates (30% deposit required).

Diversified Sourcing: Triangulate supply chains (BOE China, LG Display Korea, BOE Vietnam).

Commodity Hedging: Purchase silicon futures via exchanges.

Design Downgrades: Use a-Si instead of LTPS for consumer electronics (9-12% savings).

Module Redesign: Adopt Chip-on-Glass (COG) to reduce driver IC usage.

Used Equipment: Japanese 5th-gen line prices at 35% of new machinery.

Dynamic Safety Stock: AI-driven demand forecasting to boost turnover to 8x/year.

Shift inventory management to suppliers with 90-day payment terms.

65" panel costs to rise from 58% to 63% of BOM.

Tier-2 brands may exit North American premium markets.

Triple-screen BOM costs up $60-90/vehicle.

NIO/Li Auto already downsizing displays.

Surgical robot touchscreen budgets to increase 25-30%.

Siemens Healthineers exploring local suppliers.

Three Scenarios:

Baseline (60% probability): Stabilization post-Q3; 18-22% full-year increase.

Optimistic (20%): Chinese capacity expansion limits hikes to 12-15%.

Pessimistic (20%): Geopolitical escalation drives increases beyond 35%.

Key Indicators to Watch:

Tech trends at Korea’s Display Week.

Yangtze Memory’s 3D NAND production ramp-up.

Updates to U.S. Commerce Department’s export control lists.

Panel price surges are a structural shift, not a temporary blip. Immediate actions recommended:

Conduct supplier risk audits (Download our free Supply Chain Health Assessment Template).

Join Q3 panel procurement consortiums (Reserve your seat).

Test alternative materials (Subsidized samples available).

Expert Insight: Price negotiation alone is insufficient—adaptive supply chains are the ultimate differentiator.

Name: lily

Mobile:8613684959210

Tel:0755-27325331

Whatsapp:8618573329919

Email:sales12@huayuan-lcd.com

Add:Factory No.9, Zhongnan High-tech Intelligent Manufacturing Industrial Park, Tianyuan District, Zhuzhou,Hunan, China, 412000