November global large-size LCD TV panel shipments: BOE first, 100 inches accounted for more than 60%

Dec 30, 2024 - According to the ‘Global TV Panel Market Shipment Monthly Tracking’ report released by Runto Technology (RUNTO), the global shipment of large-size LCD TV panels reached 20.3 million pieces in November 2024, a year-on-year growth of 27.0%, and a year-on-year growth of 6.7%.

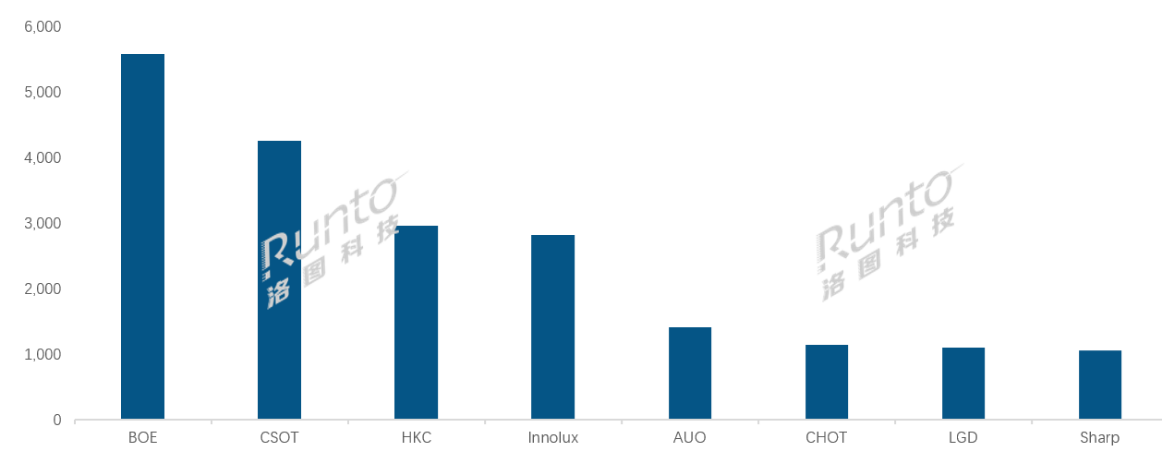

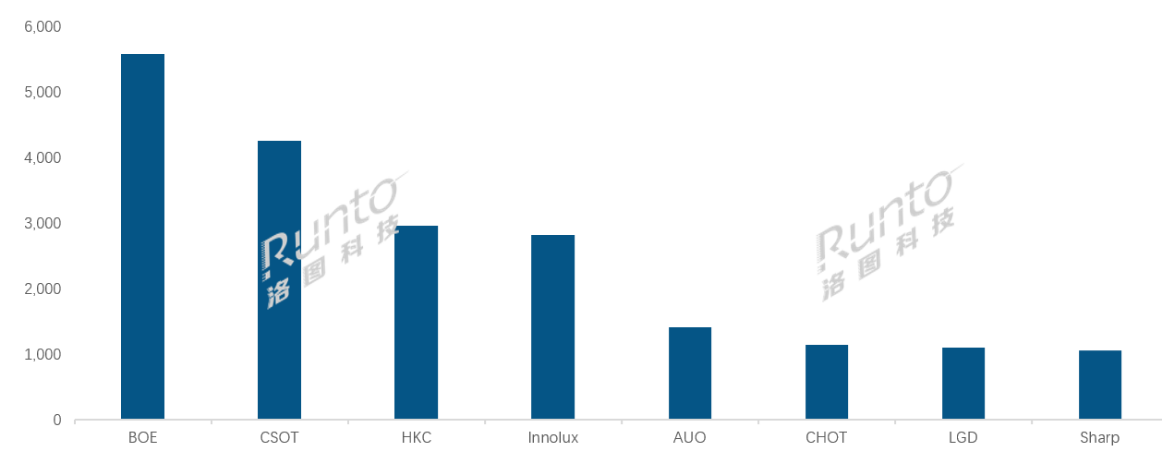

Among the major manufacturers, BOE (BOE) topped the list with approximately 5.6 million units shipped, up 47.5% year-on-year, maintaining the industry's highest growth rate for two consecutive months.

BOE led the market share in 32, 43, 65 and 86-inch product lines, and excelled in super-large 98 and 100-inch products, with combined shipments exceeding 60K for the month, of which 100-inch products accounted for as much as 63.8% of the market share.

By the end of November, BOE's 2024 cumulative shipments have reached 54M pieces, up 6.5% year-on-year, showing its absolute dominant position in the market.

Nov 2024 Global LCD TV Panel Factory Shipment Ranking

TCL Huaxing Optoelectronics (CSOT) followed closely with shipments of about 4.3M wafers in November, up 19.5% y-o-y and 21.3% y-o-y, recording the highest y-o-y growth in the industry.

The company ranks first in the world in shipments of 55- and 75-inch products, and has also maintained a leading position in the super-large 98-inch product. By the end of November, Huaxing Optoelectronics' cumulative shipments stood at 44M wafers, up 1.4% YoY.

Wyeco (HKC) shipped about 3M wafers in November, up 18.3% y/y, though down 1.1% YoY. However, in the super-large 85-inch product line, Wyeco maintained steady shipments of more than 200K, with a global market share of 33.7%, continuing to hold the No. 1 position.

In addition, the combined market share of Taiwan's two largest panel makers, Innolux (Qun Chuang) and AUO (AUO), stood at 20.8 per cent in November, down 0.3 percentage points from October, despite a 1 percentage point year-on-year increase.

Meanwhile, the combined market share of Japanese and Korean panel makers was 10.6%, down 1.0 and 0.6 percentage points year-on-year, showing a continuing downward trend.